As of November 2025, Australia’s property market continues to demonstrate steady, broad-based growth — underpinned by improving buyer confidence, a stable rate environment, and persistently tight housing supply. The latest PropTrack Home Price Index (October 2025) confirms that dwelling values are climbing nationwide, with both capital city and regional markets hitting new highs.

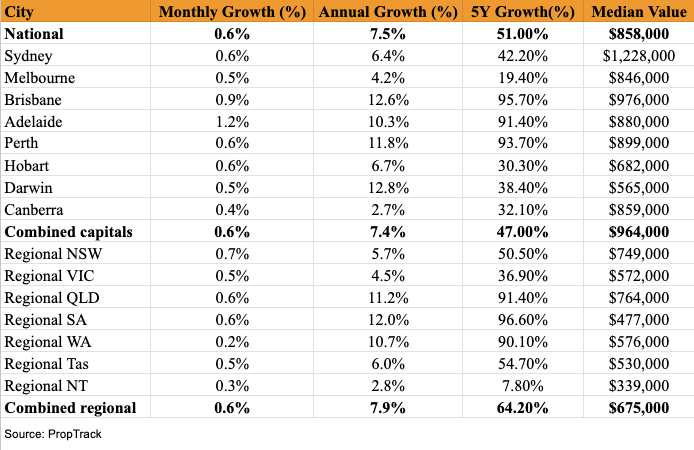

Home Prices: National home prices rose +0.6% in October. On an annual basis, values are up +7.5%, the strongest year-on-year rise in recent times. The median national home value now sits around A$858,000, which is about a 51% increase over five years.

Interest Rates: The Reserve Bank of Australia (RBA) chose to hold the cash rate at 3.60% in its latest meeting, following earlier cuts this year. Inflation remains at about 3.2% annually, prompting the RBA to maintain a cautious approach. This stability in interest rates provides a more predictable borrowing environment for both private buyers and investors.

Refinancing Surge: Refinancing activity remains strong, up around +18% year-on-year, as homeowners and investors capitalise on improved borrowing terms amid a stabilising rate environment. Investor loan activity is showing a modest uplift, driven by expectation of further price growth and tight rental/supply conditions.

Capital Cities vs Regions:

- Capital city home values increased +0.6% in October and are up +7.4% year-on-year.

- Regional home values also rose +0.6% for the month and are up +7.9% year-on-year; over five years, regions have grown around +64%, compared to about +47% for capitals.

State & Market Highlights:

- Among the capitals, the strongest monthly gains came from Adelaide (+1.2%) and Brisbane (+0.9%).

- On an annual basis, the highest growth was in Darwin (+12.8%), Brisbane (+12.6%), and Perth (+11.8%).

- Regional markets showed strong annual performance as well, e.g., regional South Australia (+12.0%) and regional Queensland (+11.2%).

Houses vs Units: Both asset types are advancing: houses up about +0.6% in October and units up +0.7% nationally — reflecting robust demand across both segments.

First-Home Buyer Impact & Market Dynamics

As predicted in my previous blog, the recent expansion of the First Home Guarantee scheme has triggered noticeable shifts in the market:

- Applications for the scheme surged +39.2% after the October amendments, which increased price caps and removed salary caps.

- State-by-state, Queensland saw a +55.2% jump in average weekly applications, followed by South Australia (~+45%) and NSW/Victoria (~+34%).

- Analysts attribute part of the recent price rises and renewed buyer urgency to this first-home buyer surge, especially in highly competitive markets with low listings.

- While this bolsters demand (a good sign for investors), it also means greater competition, particularly at entry-level price points—which can narrow negotiation margins.

InvestorPro Observations

- Time-on-market is going down in middle-ring suburbs of Brisbane, Adelaide, and Perth.

- Auction clearance rates are trending upwards, hovering around 70–75% nationally, reflecting growing buyer urgency.

- Stock levels remain well below average, roughly 18% below the five-year trend, creating competitive dynamics.

- Momentum is broadening, with Sydney and Melbourne regaining pace after a slower start to the year.

For our investor clients, this represents a strategic opportunity phase — where informed, data-driven decisions can secure long-term upside in markets still early in their growth cycles.

.png?alt=media&token=a787ed39-3447-4356-8ca9-7c50365868db)

What This Means for Investors

- Competition is intensifying, especially in properties within the ~$600K-$900K range. Entry-level markets may be especially contested due to first-home buyer support.

- Affordability remains a constraint, but improved borrowing conditions and stable rates are helping mitigate risk.

- Vendors are firmer, and negotiation leverage is narrower than during lower demand periods.

- Regional markets remain steady performers, but renewed strength across the capital cities means investors should keep a close eye on well-located metropolitan opportunities.

- First-home buyer scheme effects mean increased demand at the lower end, which can uplift adjacent markets and create spill-over benefits for investors.

Recommended Actions

- Select your criteria, get your financials sorted.

- Focus on fundamentals: Rental demand, Vacancy rates, Infrastructure growth, Supply constraints.

- Act swiftly when a property matches your investment criteria — delay may cost you.

- Be ready to make strong, competitive offers. Quality properties are attracting multiple buyers, and securing the right asset may require moving decisively.

Want to stay ahead of the market ?

and let us tailor an investment strategy to fast-track your journey.